Penny Stocks 101: Complete Guide For Beginners

If used properly and responsibly, penny stocks can play a small role in every investor’s portfolio.

Penny stock trading has risen in popularity in recent years as investors want to find undervalued companies that are poised to skyrocket in size. Young investors in particular can get a head start on their retirement savings by wisely and carefully investing or trading penny stocks in 2021.

What are penny stocks?

There is no standard definition as to what constitutes a penny stock. Some argue the definition should be taken literally — that is a penny stock refers to shares of a company that trades under $1 per share. Others expand the definition to include shares of a company trading below $5.

The vast majority of penny stocks belong to companies with a low valuation, sometimes even in the millions. Penny stock companies come from all sectors, ranging from retail, pharmaceutical, leisure, technology, etc.

Why are penny stocks so cheap?

Penny stocks are cheap for the simple reason that the underlying company has little to no reputation or track record. Many penny stock companies generate little revenue and haven’t yet demonstrated to investors a viable path to growth.

Penny stocks are cheap because there is little to no investor demand to buy shares of a company with no obvious path to growth.

Some penny stocks generate zero revenue as they are still in the pre-revenue phase of their business. This is mostly the case for the pharmaceutical industry where a drugmaker of therapies to treat a disease is years away from completing clinical trials. The company’s path towards success is far from guaranteed and the slightest setback could result in bankruptcy.

In other cases, companies that have existed for a long time can find their shares dip into penny stock territory. Remember BlackBerry? At its peak in the 2000s, the smartphone maker was the clear and dominant leader in the space. One out of every two smartphone users in the U.S. used a BlackBerry.

But as the company lost focus on the market and failed to respond to the growing competition, the stock absolutely collapsed from more than $130 in the late 2000s and was finally demoted to penny stock status in 2020.

How to find penny stock winners

Many investors view penny stocks as the ideal venue to discover winning investment ideas. Sure, buying Amazon’s stock above $3,000 per share when the company is already worth more than $1.5 trillion is a solid investment idea. If it grows 10% to 15% a year, investors will pat themselves on the back for a wise decision.

Penny stocks offer explosive growth potential.

Meanwhile, a select handful of penny stocks can gain more than 1,000% in a few months. While far from the norm and an extreme example, these types of gains occur more often than many assume.

Investors need to pay particularly close attention to the latest developments and identify themes and trends that will dominate an industry in the coming years or decades.

Here is the thought process of how savvy penny stock investors approached new ideas in 2020: The world continues to transition away from dirty fossil fuels towards clean energy technologies. Are there any overlooked companies that are positioned to address this surge in demand over the decades? Yes.

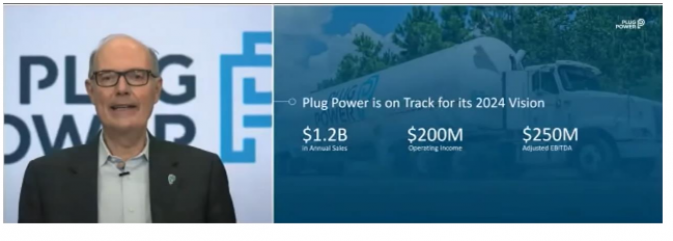

Plug Power is one of several examples. The fuel cell company develops hydrogen energy solutions and it may be decades ahead of its competition.

The stock has been hiding in plain sight for anyone to discover. On May 7, when shares were trading at just $4, the company said in a press release it is pursuing acquisitions that would help it achieve corporate goals of increasing its hydrogen demand from 27 tons a day today to 85 tons a day by 2024. More than half of that amount will be green hydrogen.

The penny stock skyrocketed after the announcement to north of $70 per share by the end of 2020.

In early 2021, stock analyst Amit Dayal, with the research firm H.C. Wainwright, said in a report the stock has even more upside to $85 per share. By 2024, Plug Power should generate $1.9 billion in revenue, according to the analyst, versus $230.2 million in 2019.

Image Source: CNBC, Plug Power

What’s the catch?

Penny stocks are ripe with fraud, deceit, scams, and criminal activity. In particular, investors that forego common sense in order to buy shares of a company that promises hefty returns may be vulnerable to penny stock scams. As the saying goes, there is a sucker born every minute.

Common penny stock scams target gullible investors who want to get rich quick.

One of the more common penny stock scams is known as “pump and dumps.” This consists of company insiders or a group of investors accumulating a large position in a stock and then hiring professional promoters to illegally lift the stock price by convincing other investors to buy the stock.

Once shares start to move higher, the insiders start to exit their position and leave victims with a stock that is worth a lot less. A legitimate company with a breakthrough product that offers a true path to growth doesn’t need to pay professional marketers to get investors to notice its stock.

In the case of Plug Power, management merely has to provide investors with an outlook and reason to believe it can be achieved.

Image source: Plug Power

Conclusion: be smart

Penny stocks are extremely risky because the present market isn’t assigning much value to a company’s growth prospects. But at the same time, many penny stocks will skyrocket in value as investors believe in its outlook.

Allocating a small part of your portfolio to penny stocks is a reasonable strategy that many investors make use of. Instead of buying 50 shares of Amazon’s stock at $3,000, consider buying 48 shares. The $6,000 you hold back can be spread out across a few penny stocks that are positioned in an industry that will see tremendous growth over the years, such as clean energy.

The downside risk to the overall portfolio can be more than offset with reasonable gains across a well-diversified portfolio.