Unpacking Copy Trading: The Best Option for Crypto Trading Newbs?

What if there was an easy way for novice traders to enter the crypto market and capture some of the best opportunities without the trading skills, time, and analysis needed to keep track and manage risk? Enter copy trading.

The fast-paced and constantly evolving crypto space is an exciting field for investors, offering a unique opportunity in an asset class that has outperformed all others over the last decade.

However, the potential on offer is not without risk, and the volatility and permissionless nature of the crypto market can seem daunting to the novice trader. But what if there was a more passive way for newbies to capture some of the best opportunities without the trading skills, time, and analysis needed to keep track and manage risk? Enter copy trading.

What Is Copy Trading?

Copy trading is a form of social trading that has grown in popularity in recent years among investors who lack the expertise or time commitment in a particular market, such as crypto. It allows traders’ positions to be replicated automatically by copiers, leveraging the skills and knowledge of those with more experience in that market.

Copiers can diversify their investment portfolio into more unfamiliar markets by allocating a percentage to expert traders in that field and copying new positions they take out at the same ratio. For example, if a copier allocates 10% of their portfolio to a particular trader, who opens a position worth 10% of their portfolio, 10% of the copy allocation would then take the same trade – equal to 1% of the copier’s overall portfolio. Alternatively, a fixed amount may be allocated to a trade or trader.

It allows traders’ positions to be replicated automatically by copiers, leveraging the skills and knowledge of those with more experience in that market.

The entire management of the trade including the opening of a position, stop losses, take profits, and closing will be copied and executed unless the copier wanted to override that for any reason, retaining the ability to control and manage individual trades. Copiers can also end the relationship with a trader at any time as copy trading does not eliminate risk, past performance is no guarantee of future success, and copiers are still responsible for the trades made.

Therefore, it is not a completely passive process as analysis of the performance, activity, and track-record of traders will still need monitoring. A diversified balance of copy traders should be used to ensure copiers are not increasing risk unnecessarily with a reliance on too few traders copied.

How Does Copy Trading Work?

Copy trading works by harnessing the social networks on trading platforms, providing transparency over the positions and performance of traders and allowing copiers to replicate professional and experienced traders automatically. Copiers can replicate all of a trader’s existing open positions, new positions as they are opened and closed, or manually select which of their trades to copy.

Copy Trading in Crypto

If you are interested in trading crypto but don’t have the time to keep track of the market, copy trading on crypto exchanges like Bingbon provides a great option, removing the hassle of implementing and managing your own strategies and relying on professional traders to place trades instead.

As one of the few crypto platforms with similar copy trading features in place, Bingbon serves as a good example to explain how the process works, offering both a demo and social copy trading service. Bingbon allows its 100,000+ users to practice and manage positions by passively and automatically copying some of the most successful traders on the platform, providing an easier entry into the market for more novice traders.

Copy trading on crypto exchanges like Bingbon provides a great option, removing the hassle of implementing and managing your own strategies and relying on professional traders to place trades instead.

After signing up for an account on Bingbon.com or via the app, copiers can navigate to the copy trade platform section where they can search a list of hundreds of traders and their profile trading data.

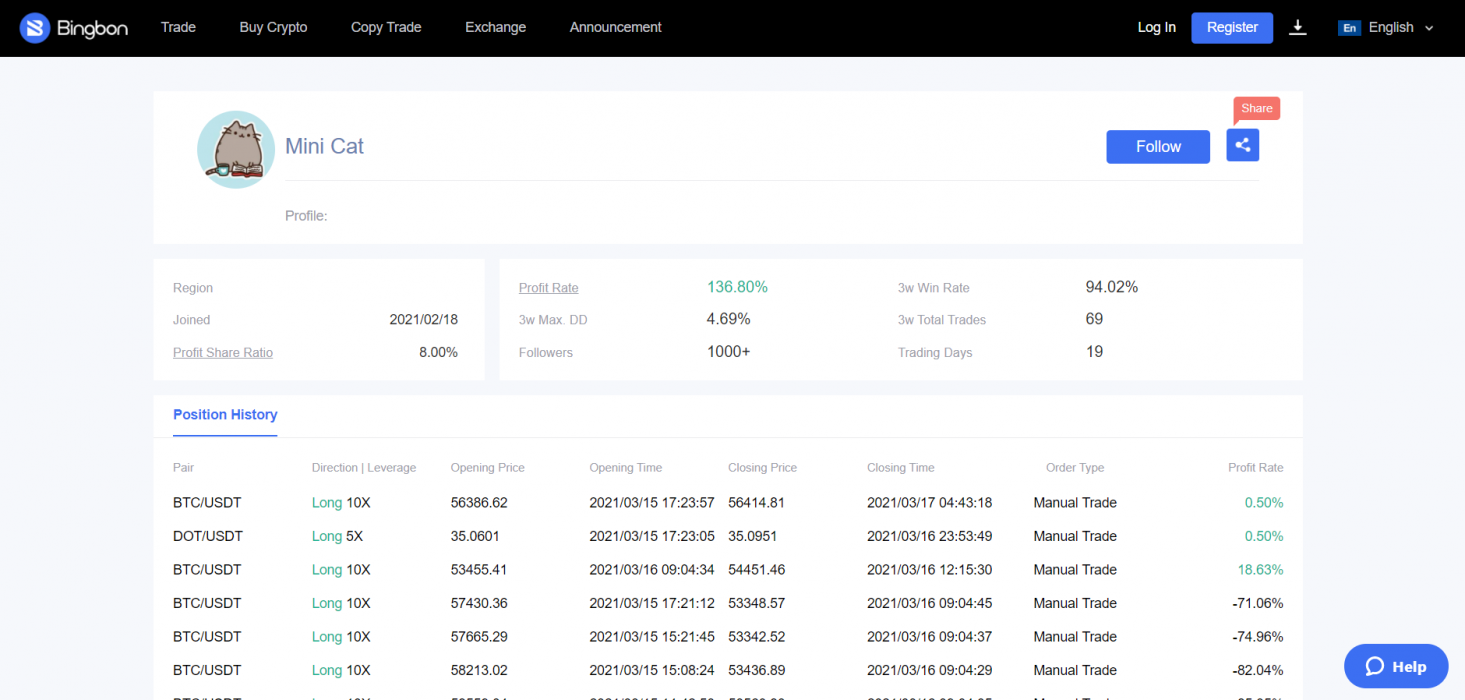

Copiers can then click on any username for a more detailed breakdown of a trader’s performance metrics including total profit, profitability percentage and win rate, time on the platform, trading style, recent trade activity, maximum losses, number of followers, and full position history. Copiers can also click on trader’s followers to see the profit history of their subscribers.

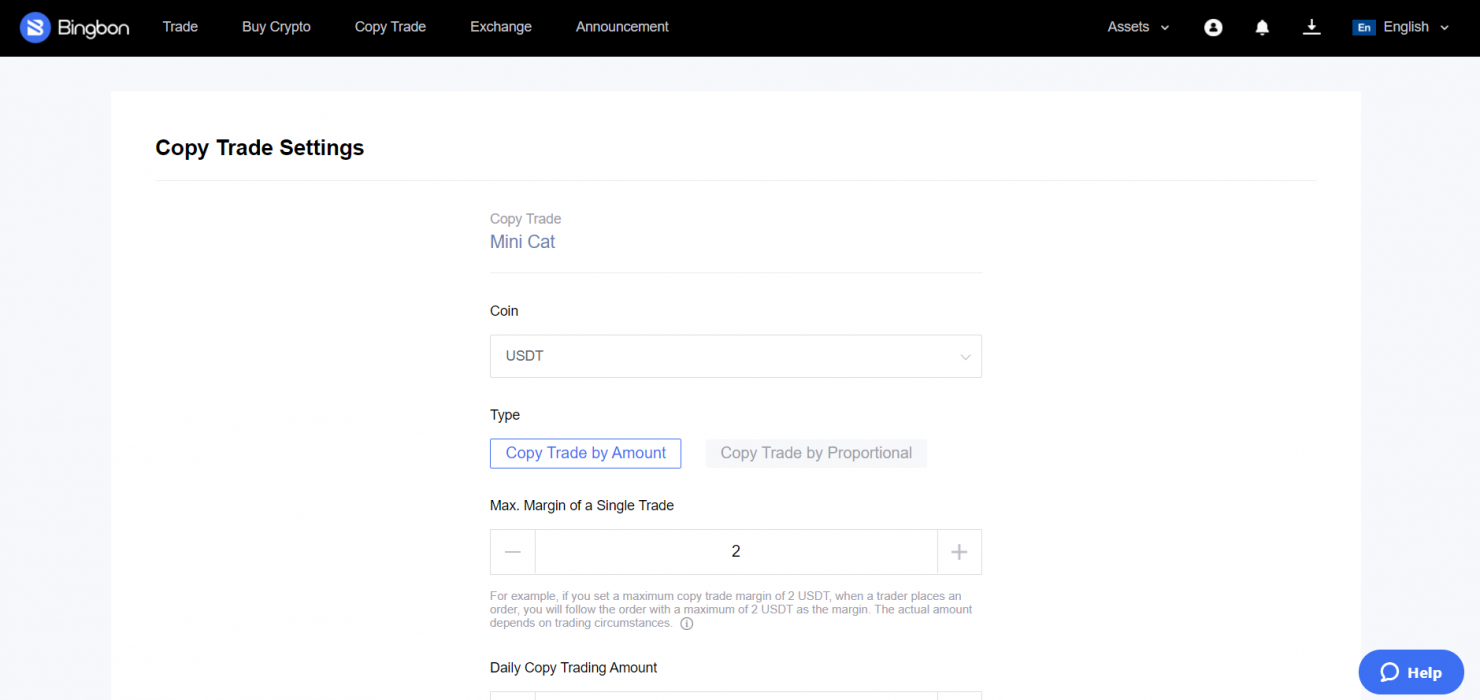

Once copiers have made a selection, they simply follow the trader and choose their copy trade settings to manage risk. This includes a proportional or fixed per trade copy amount, maximum copy limits per trade, trader, and day, maximum total position amount, and maximum stop losses, all of which can be edited at any point.

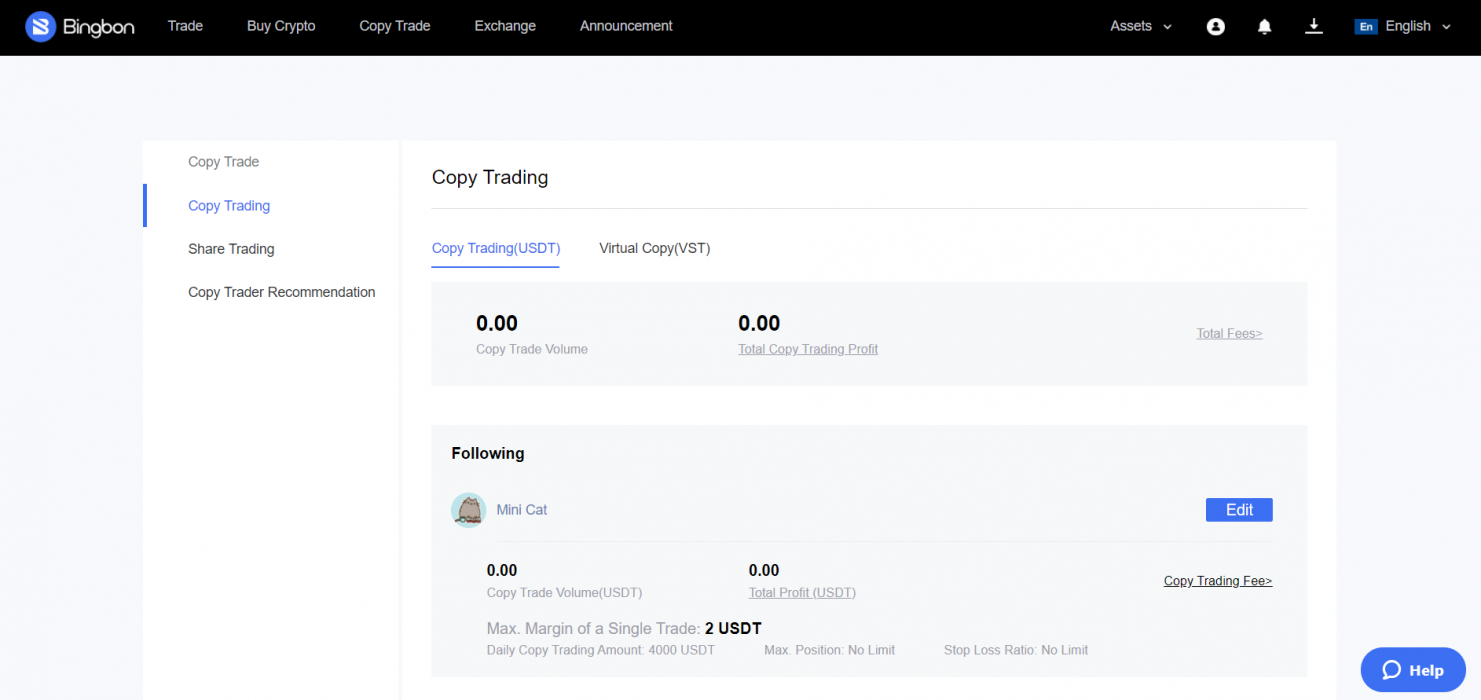

Copiers can stop copy trading via the settings page, where all copy trade positions can also be monitored. Once copiers stop copying a trader, no new trades will be copied and open trades can either be left until the trader closes them out or the copier closes them manually.

The demo copy trading functionality combined with a virtual currency is particularly useful for newbies, allowing them to get comfortable with the process and trader selections before moving over to live copy trading. While not without risk, copy trading provides a great way to diversify and allocate initially to this emerging asset class, allowing novice crypto investors to leverage expert traders more knowledgeable in the market, as is evident in the rapid growth of crypto copy trading globally.